Jeffrey Epstein Accusers Sue Deutsche Bank, Jpmorgan

Table of Content

7 On Your Side's Nina Pineda labored to carve out a contented ending for the craftsman. Women who accused Jeffrey Epstein of sexual abuse are suing Deutsche Bank AG and JPMorgan Chase & Co., saying the banks facilitated Epstein’s alleged sex-trafficking operation and ignored purple flags about their wealthy consumer. Deutsche Bank was fined by New York state’s financial regulator in 2020 for failing to correctly monitor its dealings with Jeffrey Epstein and different lapses. This web site is using a security service to protect itself from online attacks.

Of these commissions, over $500,000 went to Chase National Bank and its subagents. Banc One Corp said that the $823 million inventory swap by which it's going to buy Liberty National Bancorp of Louisville KY shall be completed Aug 15, 1994. "Banc One To Buy Universal".

Historical Past

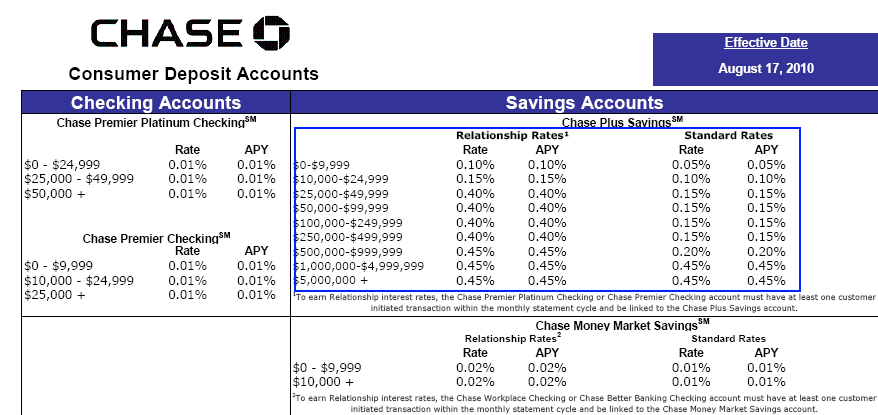

In October 2010, Chase was named in two lawsuits alleging manipulation of the silver market. The suits allege that by managing giant positions in silver futures and options, the banks influenced the prices of silver on the New York Stock Exchange's Comex Exchange since early 2008. Bank One Arizona, attracted by a network of bank branches in grocery shops, yesterday purchased fifty eight of Great American Bank's 60 Arizona workplaces from the Resolution Trust Corp.

Though the early reviews of J.P. Morgan-Bank One have been favorable, there’s no proof early evaluations are an excellent predictor of ultimate success, she notes. Many mergers that look good on paper falter through poor execution and culture clashes. After all, not many experts can predict the future for firms that are not involved in mergers. By comparison, investors have been unenthusiastic concerning the $48 billion Bank of America-FleetBoston deal.

Suggestions For Finding The Best Financial Institution

The following year, Banc One acquired 13 Houston-area workplaces of the failed Benjamin Franklin Savings from the RTC for $36 million. With the change in federal and state banking laws in 1985, Banc One started to quickly expand exterior of Ohio. Its first out-of-state acquisition was of Purdue National Bank in Lafayette, Indiana which occurred just after the model new legal guidelines went into impact. This financial institution was renamed Bank One Lafayette. This merger was shortly adopted by the acquisition of other small banks in Indiana and Kentucky, the one states that originally allowed bank purchases by Ohio-based banks. Initially, Ohio regulation did not permit financial institution mergers throughout county lines but allowed financial institution holding corporations to own a number of banks across the state with some geographical restrictions.

Citizens Union National renamed Bank One Lexington, had $246.2 million in property as of March 31. Purdue National, renamed Bank One of Lafayette, had belongings of $372.2 million at the end of the first quarter. Banc One Corp. mentioned it agreed in principle to acquire Lake County National Bank in Painsville in an change of inventory. Lake County National...has assets of $411 million. At this time, First USA was producing income as high as almost 25% on its house owners' funding, which was phenomenal since a return of 1% on its belongings is often considered nice for many different sectors of banking. The excessive price of return was one of the factors that attracted Banc One to the acquisition of First USA.

You're Unable To Entry Banklocationmapsde

First USA ranks as the nation's 14th-largest issuer of Visa and MasterCard accounts, having distributed 2.9 million playing cards with outstanding balances of $2.2 billion... In a enterprise the place a bank hopes to earn a revenue equal to 1 % of its property, First USA Bank makes a minimum of twice that a lot. In the last six months of 1991, the financial institution generated a return of nearly 25 % on its homeowners' funding... The bank's father or mother firm has made less cash, even dipping into the purple in 1990. But that's as a outcome of the parent company must pay interest on loans it borrowed to buy First USA within the 1989 buyout. The new stock providing should assist cut back that debt load...

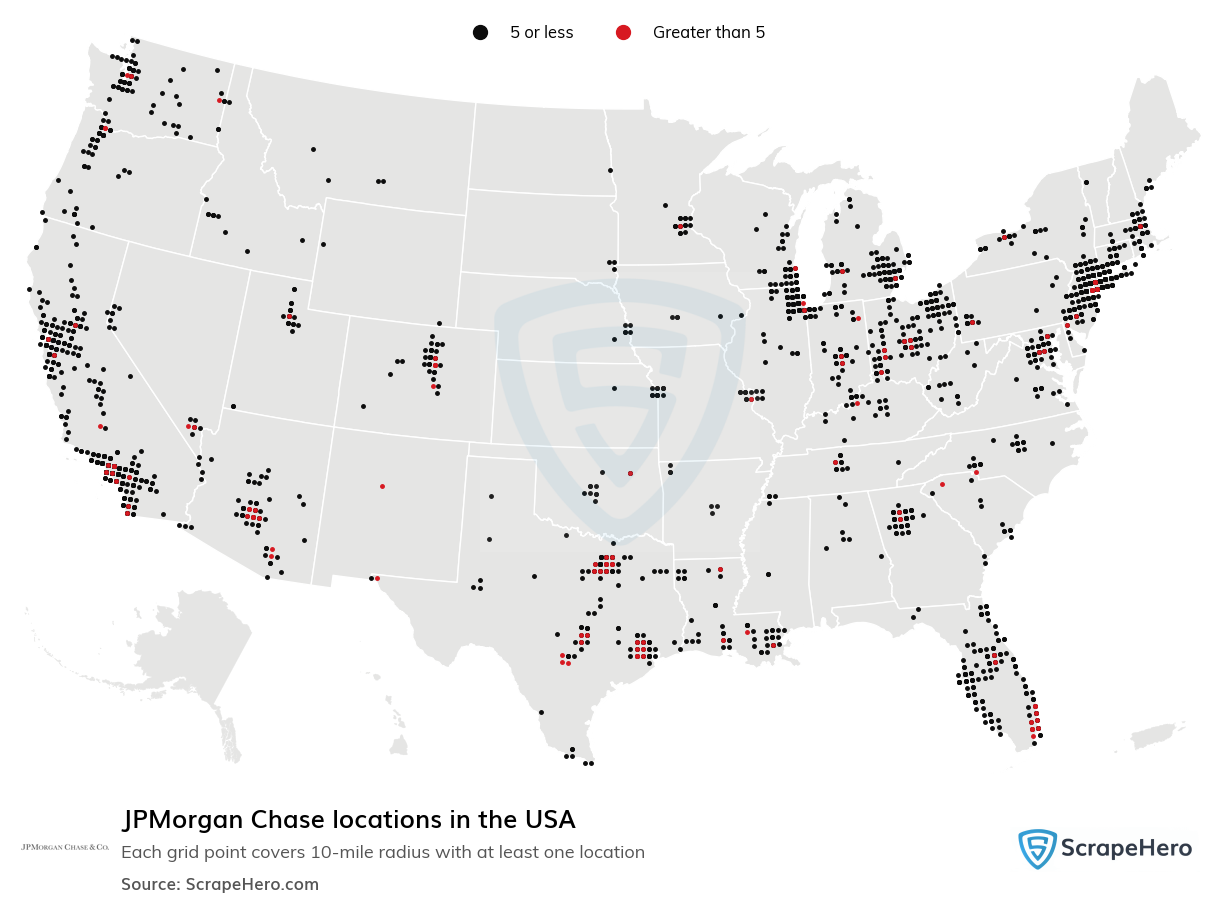

Chase Manhattan Bank was shaped by the merger of the Chase National Bank and the Manhattan Company in 1955. The financial institution merged with Bank One Corporation in 2004 and later acquired the deposits and most belongings of Washington Mutual. Lomas Bankers' main subsidiary, Lomas Bank USA, ranks as the nation's 11th-largest issuer of credit cards. On June 30, the Delaware-based institution served 1.7 million credit-card accounts with excellent receivables of $1.35 billion. The subsidiary bank might be referred to as First USA Bank, and nine affiliated firms will get similar monikers. Lomas Financial sold the mother or father financial institution for $435 million in money and $65 million in 10-year redeemable preferred inventory.

At the time of the acquisition in 1998, First Commerce was the largest Louisiana-based financial institution within the state. The acquisition included the lead financial institution First National Bank of Commerce plus five other regional banks with a mixed complete of one hundred forty four banking offices. All of the acquired banks have been consolidated into Bank One Louisiana. Both savings accounts additionally automatically provide you entry to Capital One’s Automatic Savings Plan. This plan basically let’s you give Capital One permission to economize for you. You simply have to inform the financial institution how much money you’d like to save, and how usually you want it transferred to your 360 Savings account.

The subsidiary, MNet, signed a letter of intent to buy the credit card accounts from Louisiana National Bank and Guaranty Bank & Trust. MNet's bank card operation at present has 800,000 accounts. Bank One Texas expanded its Houston franchise Friday with the purchase of 13 branches of the failed Benjamin Franklin Federal Savings Association. In the method, the Dallas-based bank additionally picked up $1.forty seven billion in deposit accounts from the thrift.

House Equity Line Of Credit

Plus, none of the Capital One 360 accounts charge a monthly charge and a lot of the accounts don’t require a minimal opening deposit. First USA unique was initially formed in Dallas as a subsidiary of MCorp that was called MNet. It was shaped in 1985 to deal with the back finish work for offering credit cards, electronic banking, and different shopper companies through member banks of the Texas financial institution holding company. In try to keep away from wasting itself, MCorp bought MNet to Lomas & Nettleton Financial Corporation the next yr for $300 million in cash and securities.

Its major office is positioned at 9633 Lyndale Av. S., and it operates branches in Apple Valley and western Bloomington. Limited interstate banking was approved by both the Minnesota and Wisconsin Legislatures earlier this yr. Each legislation allows the acquisition of banks throughout state strains with other Midwestern states that cross related laws. The Minnesota regulation is limited to the four bordering states, and Wisconsin is the only a sort of states that has handed such legislation. The Wall Street Journal (Eastern ed.).

Comments

Post a Comment